No products in the cart.

Acacia Ridge, QLD

How Unikorn helped owners of this property achieve a net rental yield of 7.09% annually

Property highlights

Some of the highlights for this property Acacia Ridge, QLD include:

Potential Capital Growth

Based on its purchase price and market projections, the property holds the potential for capital appreciation. With estimated valuations ranging from $892,500.00 to $935,000.00, our clients can anticipate favourable returns on their investment over time.

Net Rent and Yield

The property generates a net rent of $60,275.00 annually, resulting in a solid yield of 7.09%. This attractive yield demonstrates the property's income-generating potential relative to its purchase price.

Location

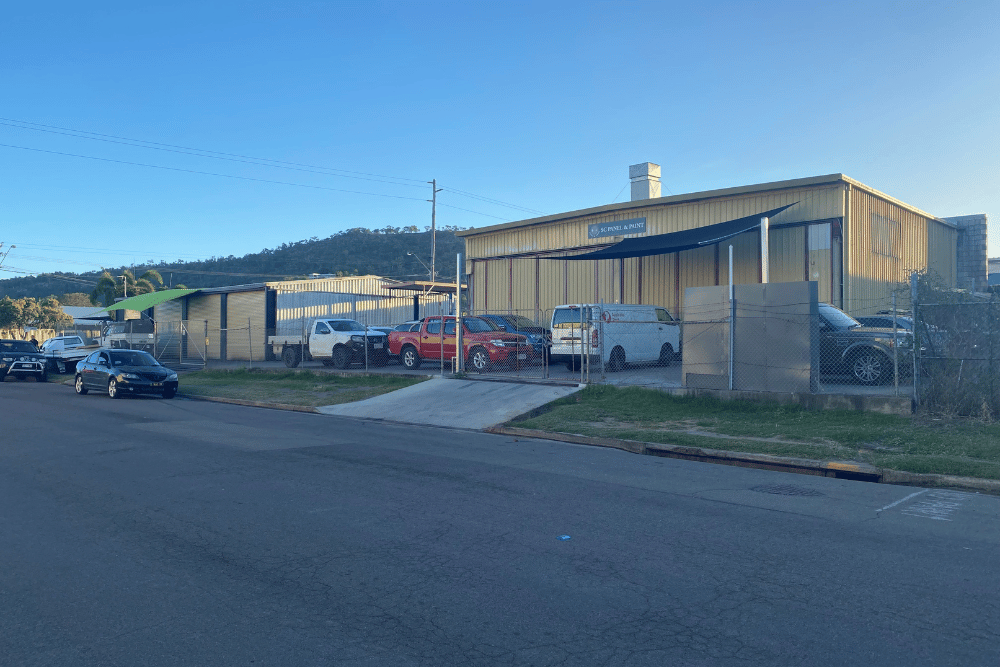

Situated in the vibrant suburb of Acacia Ridge, QLD, the property benefits from its strategic location within a growing real estate market, offering accessibility to major transportation routes and commercial centres.

Quick facts and figures

Purchase price

$850,000

Deposit

$297,500

Costs

$55,800

Net rent

$60,275

Rental yield (Rental/Price)

7.09%

The results

With Unikorn’s help, we were able to help the owners of this property secure the following results:

- A total positive cashflow of $27,180.25

- Cash on cash return of 7.69%, indicating strong financial performance relative to the initial cash investment

- Managed to lower the purchasing price of the property, from its original valuation price of $905,800 to $850,000.

- Established a favourable yield of 7.09%, demonstrating the property’s income-generating potential relative to its purchase price

- Successfully acquired a property with stable tenancies in the meat processing and cooking facilities sector, ensuring consistent rental income

- Implemented strategic financing with a 65% loan-to-value ratio, optimising leverage while minimising cash outlay

- Demonstrated prudent expense management with a calculated approach to estimated expenses, ensuring profitability and long-term viability

Conclusion

The commercial property at 73, Oxley Street, Acacia Ridge, QLD 4110 stands as a testament to the successful collaboration between the property owners and Unikorn, resulting in strong financial achievements and strategic growth opportunities.

Through meticulous analysis and strategic planning, Unikorn facilitated the attainment of a net rental yield of 7.09% annually, surpassing industry benchmarks and reflecting the property's potential for income generation.

By leveraging Unikorn's expertise in tenant optimisation, value-added improvements, and expense management, the property owners were able to maximise rental income while minimising costs, leading to a positive cashflow and favourable cash-on-cash return.

Furthermore, Unikorn's proactive vacancy reduction strategies, lease structuring, and market analysis contributed to the property's stability and long-term viability, ensuring consistent rental income and positioning the property for potential capital growth.

Overall, the collaborative efforts between the property owners and Unikorn have resulted in a successful investment venture, highlighting the value of strategic property management and expertise in optimising rental yields and maximising profitability.

WE ARE SPECIALISTS IN UPLIFT AND VALUE ADDITION DEALS AND DEALS WITH DEVELOPMENTAL POTENTIAL

Higher Yield

6% - 10% on average (depending on area and risk)

Diversified Portfolio

Portfolio design is the key to long-term financial stability

Hassle-Free

You can still borrow even if serviceability is tapped out.

Lower Costs

Lower costs vs. residential + less things to manage

Set & Forget

Tenant pays all outgoings allowing you to set & forget

Unikorn’s solutions

Every client—whether new or more experienced—starts with a strategy session with the Unikorn team to understand the investor’s long-term financial goals, budgetary requirements and overall preferences in their commercial property selection. Upon assessing the investor’s requirements, we devised a long-term and effective strategy to help the investor maximise their property earning potential and minimise expenses. Our solutions included:

Strategic purchase price negotiation

Unikorn's expert negotiation skills were instrumental in securing a favourable purchase price of $850,000.00 for the property, ensuring maximum value for the investors and optimising their return on investment.

Identified Positive Cash Flow Opportunities

Through meticulous financial analysis, Unikorn identified potential positive cash flow opportunities, resulting in a substantial annual positive cash flow of $27,180.25. By accurately assessing expenses and rental income, Unikorn ensured the property's profitability from the outset.

Maximised Cash-on-Cash Returns

Unikorn's tailored solutions and efficient management strategies contributed to a strong cash-on-cash return of 7.69%, showcasing the property's exceptional financial performance relative to the initial cash investment. This demonstrates Unikorn's commitment to maximising returns for its clients.

Potential Capital Growth Analysis:

Unikorn provided insights into the potential capital growth of the property, with estimated valuations ranging from $892,500.00 to $935,000.00. This analysis helped investors understand the long-term appreciation potential of their investment, allowing them to make informed decisions.

Comprehensive Due Diligence

Unikorn conducted comprehensive due diligence, including pest and building inspections, valuation reports, and legal assessments, ensuring that investors had a clear understanding of the property's condition and legal status before proceeding with the purchase.

Proactive Lease Management

With tenancies in place for meat processing and cooking facilities under secure lease terms of 3 x 2 x 5 years, Unikorn ensured a stable income stream for investors. By managing the leasing process effectively, Unikorn helped mitigate vacancy risks and optimise rental income.

Why work with Unikorn

When it comes to building generational wealth, commercial property investing can help you get the returns you’re looking for. However, working with many prospective investors, we understand that many people who want to get into commercial real estate don’t have the expertise—and ultimately the confidence—to become savvy investors.

Our team of experienced real estate investors are here to help you get the guidance and support you need throughout your investment journey whether it’s searching for the right property, securing the right financier, or negotiating a better deal.

1000+

Unikorn deals and counting

5

Strict point selection criteria

30+

Experts working with you

5/5

Facebook Rating

Featured as Commercial Property Expert on…